CoinJar,

a startup that launched a bitcoin wallet with 10,000 registered users

in Australia, has secured a A$500,000 ($455,000) seed round led by

Australian venture capital firm Blackbird Ventures, which put in $228,000.

CoinJar,

a startup that launched a bitcoin wallet with 10,000 registered users

in Australia, has secured a A$500,000 ($455,000) seed round led by

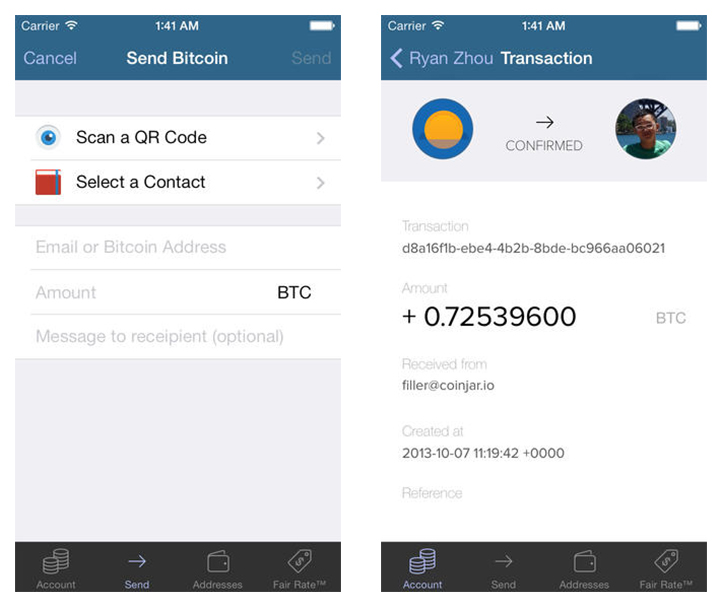

Australian venture capital firm Blackbird Ventures, which put in $228,000.CoinJar’s wallet, available for the iPhone, has a couple of unique features. It is a ‘managed wallet’, which means it doesn’t require the downloading of the blockchain to work. The blockchain, which has exceeded 10GB in size, is a public ledger containing a record of all bitcoin transactions in history.

Security-wise, CoinJar is encrypted with SSL and has Two-Factor Authentication.

In conjunction with the wallet, the startup operates CoinJar Filler, a bitcoin exchange. Available only in Australia for now, it charges a two percent flat fee for buying and 1.1 percent for selling. It also has the ‘CoinJar Fair Rate’, a proprietary exchange rate purportedly reflecting the true price of Bitcoin.

This, it claims, enables it to offer bitcoin at prices and fees lower than that of other Australian exchanges like SpendBitcoins, Omnicoins, and Buy Bitcoin Australia. Since launching in May, the exchange is done over $1.82 million in trades.

Lastly, CoinJar also operates a payment gateway that enables merchants to accept payments in bitcoin without worrying about exchange rates and Bitcoin address handling. Online businesses are charged a one percent merchant fee, which is two to four times less than what PayPal charges.

The company, an alumnus of Melbourne startup accelerator AngelCube, is founded by CEO Asher Tan, a former market analyst, and Ryan Zhou, who previously started and sold bitcoin exchange Bitcoinica, which was later shut down after a series of hacking incidents that saw over $400,000 worth of bitcoins siphoned off.

Despite the cryptocurrency being mostly a speculation vehicle for investors, Asher believes that “it is only a matter of time until business and consumers take full advantage of Bitcoin as a solution to digital payments.”

While acknowledging to Tech in Asia that Bitcoin is “still an inefficient market leading to arbitrage opportunities and speculation,” he believes the growth in “exchanges, market makers, and wallets” will lead to more volume and liquidity but decrease margins for speculative behavior.

CoinJar has been doing its part by securing partnerships with goods and service providers to increase merchant adoption of the currency in Australia. As a result, crowdfunding site Pozible and utility vehicle producer Tomcar have begun accepting bitcoin through CoinJar’s payment gateway.

In Tomcar’s case, bitcoin prices are calculated in realtime and adjusted by CoinJar according to the exchange rate. This prevents its products from being sold at rock-bottom prices in the event of a bitcoin crash.

Bitcoin has been on a roll of late, soaring to over $1,100 a bitcoin. According to Bitcoincharts.com, the value of all bitcoins is now worth over $12 billion.

This has enriched many early investors, but has also caused other bitcoin miners to grovel in grief after accidentally throwing away millions in dollars worth of the currency.

No comments:

Post a Comment